4 The BangNano Prosperity Pyramid

The 3-Step Path to Financial Independence

After laying the groundwork in earlier chapters—understanding the fundamentals of riba-free economics, recognizing how inflation and debt traps work, and appreciating the Islamic perspective on wealth—we now arrive at a turning point: putting these principles into action.

Achieving true financial independence isn’t just about earning more money—it’s about structuring your wealth in a way that ensures stability, growth, and impact. Without a structured plan, many people either fall into financial traps (debt, inflation, reckless investments) or miss opportunities to build sustainable wealth. That’s why a clear, step-by-step approach is needed.

This chapter lays out the practical roadmap for reaching financial independence in a sustainable and ethical way. You will learn how to:

- Define what financial independence means in an Islamic framework.

- Assess your current financial position and what needs to change.

- Differentiate between active and passive income and set financial targets.

- Plan a 5-Year Path to Financial Independence.

- Understand a structured framework for protecting, growing, and sharing wealth.

By the end of this chapter, you will have a clear understanding of the BangNano approach to financial independence and how to apply it in your own life.

What Is True Financial Independence?

When many people hear the phrase “financial independence,” they often think of one of two extremes: being extravagantly wealthy or, conversely, having minimal expenses so you can live off very little. However, true financial independence in the BangNano framework goes beyond the superficial notion of having a big bank balance. It’s about:

- No Longer Being Trapped by Riba: You’re not dependent on interest-based loans or credit cards that drain your resources.

- Covering Your Basic Needs Through Passive Income: Even if you decide not to work for a month or two, or if life circumstances force you to slow down, you still have enough money (or money-equivalent assets) coming in to cover essentials like food, shelter, and healthcare.

- Having Time and Flexibility: You’re not trading all your time for money, nor are you locked into a job or business you despise just because you need the paycheck to survive.

- Being Able to Contribute: You have the mental bandwidth and financial capacity to help your family, support community projects, or volunteer for causes you believe in—all without worrying that you’ll go broke.

In other words, financial independence is the independence to live life on your terms, guided by Islamic values and principles of justice, fairness, and shared prosperity. It doesn’t mean you stop working; rather, you work by choice, not by necessity. You become a steward of your resources, using them to benefit yourself, your loved ones, and society.

Prerequisites for the Journey

Just like you wouldn’t attempt a marathon without some basic fitness level and training, you need a few prerequisites in place before you tackle financial independence. Here are four crucial elements:

Be Diligent in Accounting Your Finances

You can’t begin to fix or optimize what you’re not measuring. One of the greatest pitfalls people face is a lack of clarity about where their money is actually going. Are you spending more than you realize on non-essentials? Are you regularly short on funds but not sure why?

- Track All Income and Expenses: Start with a simple spreadsheet or even a pen-and-paper journal. Write down your monthly income from every source, and note every expense—from big-ticket bills like rent or car payments down to small daily items like snacks.

- Identify Patterns: After a month or two, you’ll see patterns emerge. Maybe you’re overspending on groceries or online shopping without noticing. This awareness is the first step toward better budgeting and setting your financial goals.

Self-Discipline to Control Your Finances

Once you know where your money is going, you need the discipline to redirect it according to your financial priorities. This means:

- Learning to Say “No”: If you’re currently spending on luxuries or non-essentials, consider cutting back. At least temporarily, funnel the extra savings into assets or programs that will protect and grow your wealth.

- Creating (and Sticking to) a Budget: Set realistic limits for categories like groceries, entertainment, personal spending, and so on. The key is consistency.

This step isn’t about depriving yourself indefinitely; it’s about delayed gratification—sacrificing certain short-term indulgences so you can experience more significant, lasting rewards in the near future.

Support from Family or Spouse

Financial independence is much harder to achieve if your family or spouse isn’t on the same page. Picture a boat with two people rowing in opposite directions: you’ll go nowhere fast.

- Have Open Discussions: Share your vision for living riba-free and building real, sustainable wealth. Explain why you might be making lifestyle changes—like canceling unnecessary subscriptions or cooking at home more often.

- Set Common Goals: Perhaps you both want to buy a home without a mortgage (riba-based interest), or you want to save for your children’s education in a more ethical way. Having shared objectives keeps everyone motivated.

Community Support

Going it alone, especially in a world saturated with riba-based systems, can be overwhelming. You’ll likely face skepticism or pressure from peers who don’t understand your approach. That’s why having a community—like the BangNano Movement—can be transformative.

- Moral and Emotional Support: Being around like-minded individuals who share your values provides reassurance and encouragement.

- Collaboration Opportunities: One of the great strengths of BangNano is its trust-based network, which makes it easier to find ethical investments or borrow without riba.

- Accountability: When your peers are also monitoring their finances, avoiding predatory loans, and building real assets, you’ll be less likely to stray from your own plan.

Understanding the Two Types of Income Sources

When it comes to your personal finances, all the money you earn falls into one of two categories:

Active Income – Trading Time for Money

This is the money you make when you work. If you have a job, run a small business that depends on your daily involvement, or do freelance or consulting work, you’re earning active income. The moment you stop working, the money stops coming in.Passive Income – Earning Without Constant Work

Now, imagine making money even when you’re not working. That’s passive income. Maybe you own a rental property, earn dividends from a business you’ve invested in, or see returns from other riba-free investments. It takes some effort to set up, and you’ll need to manage it, but once it’s running, it doesn’t demand your daily attention.

Earning active income is the easy part—get a job, start freelancing, or launch a business. But if you want real financial independence, the key is building enough passive income to cover your monthly needs. That way, you can stop trading all your time for money and start living life on your terms.

Setting Financial Targets

How do you measure “enough” passive income? The answer lies in your monthly expenses. Let’s break it down.

Calculating Your Monthly Survival Expenses

First, figure out how much money you need each month to cover your basic living costs. This includes:

- Rent or mortgage payments

- Food

- Utilities (electricity, water, phone, internet)

- Transportation

- Essential healthcare

- Childcare or education expenses

- Other absolute necessities specific to your situation

Let’s call this your baseline monthly expenditure. For instance, if you can survive reasonably (though not luxuriously) on $1,000 a month, then that figure is your baseline.

Determining Your Financial Independence Target

Now, your target is to generate at least $1,000 (in our example) per month in passive or near-passive income. This doesn’t have to happen overnight. The BangNano Prosperity Pyramid is designed to help you reach this point systematically, often within around five years, depending on your situation.

- Scaling Up: If you want a bit more comfort—say you can do more charitable work, save for a child’s future, or afford better healthcare coverage—then set your passive income target a bit higher than $1,000, maybe $1,500.

- Keep It Realistic: Don’t jump to an unreasonably large target unless you have a strategy to get there. Overly ambitious goals can lead to frustration if progress seems too slow.

The important thing is that once your monthly basic needs are covered by passive income, you’re functionally free: you can choose to keep working actively for a higher standard of living or to spend more time on family, community, or spiritual pursuits.

The 5-Year Plan to Financial Independence

You might be wondering, “Why 5 years?” The number 5 isn’t magic, but it’s a reasonable timeframe in which most people—if they’re disciplined—can transition to financial independence using the BangNano approach. Some might reach their goals in 3 years, others might need 7 or 10. But 5 years provides a structured horizon to strive for.

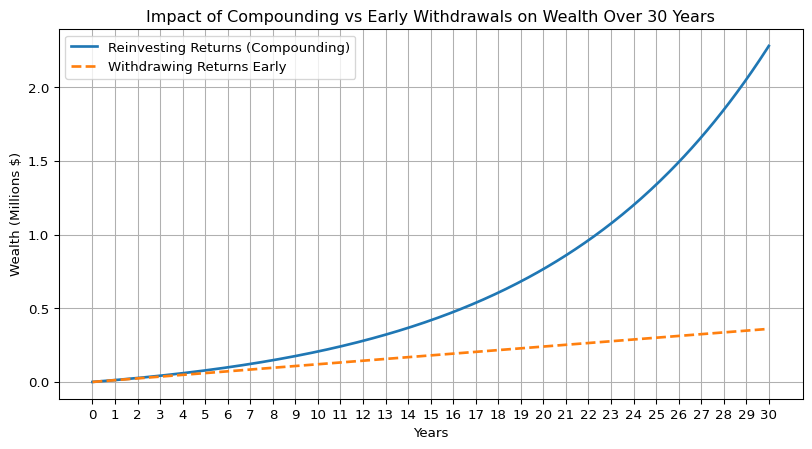

The Power of Compounding vs. Early Withdrawals

One of the biggest lessons in wealth-building is delayed gratification. Many people fall into the trap of withdrawing their investment returns early, believing that small, immediate gains are enough. However, the real power of wealth creation comes from compounding—allowing your money to grow exponentially over time by reinvesting returns rather than spending them.

To illustrate this, let’s consider two individuals who both save $1,000 per month and earn 10% annual returns on their investments. One chooses to reinvest all returns (compounding), while the other withdraws their investment gains every year instead of reinvesting. (See Figure 4.1 )

After 30 years, the difference is staggering:

- The investor who reinvests everything ends up with $2.28 million.

- The investor who withdraws their yearly returns only accumulates $360,000 in total wealth.

Despite withdrawing a total of $256,578 in returns over the years, the second investor’s total wealth remains far lower. The reason? Every time they withdrew their gains, they reduced the base amount that could compound further.

This demonstrates a key financial principle: wealth grows exponentially when left untouched. The longer you allow your money to reinvest and grow, the more dramatic the difference becomes. This is why the BangNano Prosperity Pyramid emphasizes long-term patience. By resisting the urge to cash out early and instead letting wealth accumulate, you can achieve true financial independence much faster.

The Role of Delayed Gratification

To tap into the full potential of compounding, you often need to resist the urge to withdraw money early. It’s like planting a seed and letting the tree grow until it bears plenty of fruit. If you pick the fruits too early—or keep shaking the tree for smaller gains—the overall yield will be less. For many, this is the hardest part: living modestly now so you can live more freely later.

Dealing with Setbacks

Life happens. You may encounter unexpected expenses, lose your job, or have family emergencies. That’s why the BangNano Prosperity Pyramid encourages you to build up savings, stable assets, and a small emergency fund so that when setbacks occur, you don’t completely derail your plan. Even if you have to pause or scale back your investment contributions, the idea is to stay the course. Use the community support, rely on your stable assets, and resume as soon as you can.

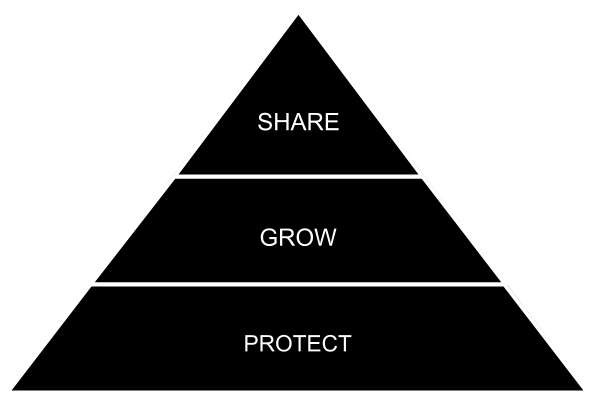

A Deep Dive into the BangNano Prosperity Pyramid

Throughout this book, we’ve explored the foundations of a riba-free economy, the dangers of debt and inflation, and the Islamic principles that guide ethical wealth-building. Now, it’s time to put everything into action with a structured, step-by-step approach to achieving financial independence.

At the heart of the BangNano financial roadmap is the BangNano Prosperity Pyramid (See Figure 8.1)—a simple yet powerful framework designed to protect, grow, and share wealth in a sustainable, faith-aligned manner. This model ensures that financial independence isn’t just about personal gain, but about building a community of prosperity where everyone has the opportunity to thrive.

The Prosperity Pyramid draws inspiration from Almir Colan’s Shepherd’s Framework 1 and has been adapted within the BangNano Movement to create a practical, community-driven economic system.

Here’s a quick overview:

Step 1: Protect Your Wealth

- Before you even think about building wealth, you must protect what you already have.

- This involves shielding yourself from inflation, riba-based debt, fraud, and emergencies.

- Common ways to do this include converting your savings into gold or other real assets, reducing or restructuring existing debt, and having an emergency fund.

- We’ll detail this in Chapter 5.

Step 2: Grow Your Wealth

- Once your foundation is stable and you’ve minimized leaks (like high-interest debt and reckless spending), it’s time to expand.

- You look for riba-free investment opportunities—like fractional real estate, musyarakah mutanaqisah (partnership), mudharabah (profit-sharing), small-business seed financing, and more.

- The goal is to build enough passive income to cover your monthly expenses.

- We’ll explore this in Chapter 6.

Inverted Approach of Modern Capitalism vs. The BangNano Pyramid

Notice how this pyramid is almost the inverse of what modern capitalistic systems often encourage. In many mainstream approaches, people are pressured to “invest” before they’ve built any solid financial foundation—sometimes taking on substantial debt to do so. They might chase short-term gains in speculative markets, risking what little they have. And giving back often becomes an afterthought, if it’s considered at all.

With BangNano, we start by ensuring you’re protected against common financial hazards. Then we methodically move toward growth. Finally, once you’re stable and growing, we encourage you to help others achieve the same independence. This ensures that your entire community rises, not just a privileged few.

Why This Pyramid Works (and Why It’s Different)

The BangNano Prosperity Pyramid is unique because it:

- Prioritizes Riba-Free Methods: Every level of the pyramid relies on ethical, Sharia-compliant financing methods. This not only aligns with Islamic values but also prevents the exploitative debt structures common in conventional banking.

- Emphasizes Community and Transparency: Accountability is embedded in the system. The use of member identity verifications, connection-chains (sanad), and public ledgers for major transactions ensures that people can trust each other’s reputation and asset holdings.

- Builds Momentum Gradually: The system doesn’t promise overnight riches. Instead, it’s about steady, sustainable growth—mirroring the concept of barakah (blessing) in Islamic tradition.

- Encourages a Balanced Life: The ultimate goal is not merely financial gain, but a well-rounded existence where you have enough time and energy for worship, family, and community.

Putting It All Together: Your Roadmap

So how do you actually use this pyramid in practice?

- Start with Step 1: Protect Your Wealth

- Assess your debts, monthly expenses, and any risks you’re facing (like inflation or lack of an emergency fund).

- Convert a portion of your cash savings into stable, tangible assets like gold or staple goods.

- Ensure you have enough buffer for unexpected emergencies.

- Assess your debts, monthly expenses, and any risks you’re facing (like inflation or lack of an emergency fund).

- Move On to Step 2: Grow Your Wealth

- With your foundation secure, begin exploring riba-free investments.

- Leverage the community: join funding programs where you can pool resources to invest in partnerships or profit-sharing initiatives, such as motorcycle rentals, small business seed funding, etc.

- With your foundation secure, begin exploring riba-free investments.

- Finally, Embrace Step 3: Share and Build a Legacy

- Once your own finances are solid, look outward. Mentor new members, contribute to Qardul Hasan (interest-free loan) funds, and possibly set up philanthropic ventures or learning centers.

- The goal is to multiply not just your wealth, but also your impact—both in this life and the hereafter.

- Once your own finances are solid, look outward. Mentor new members, contribute to Qardul Hasan (interest-free loan) funds, and possibly set up philanthropic ventures or learning centers.

Timeline and Flexibility

Everyone’s journey is different. Some might move through these steps in just a couple of years if they already have considerable savings or a high-paying job. Others might take a decade. The beauty of the pyramid is that it accommodates various paces. The key is consistency and a willingness to adapt as you learn more and as your circumstances change.

Preparing for the Next Chapters

This chapter sets the stage for the detailed guides in the following sections:

- Chapter 5 (Step 1: Protect Your Wealth) will outline the specific tactics for shielding your resources from inflation, riba-based debt, fraud, and emergencies.

- Chapter 6 (Step 2: Grow Your Wealth) will dive into different investment programs within BangNano—like fractional real estate, motor vehicle, and Mudharabah (profit-sharing) programs—so you can systematically build your passive income.

- Chapter 7 (Step 3: Share Your Wealth & Build a Legacy) will show how to ensure your success benefits your community, generates ongoing Pahala (spiritual rewards), and fosters a cycle of trust and prosperity.

By the time you finish those chapters, you’ll have a comprehensive toolkit for transforming your financial situation—and the knowledge to help others transform theirs. That is the essence of the BangNano vision: a community rising together in an ethical, transparent, and spiritually uplifting manner.

Common Misconceptions Addressed

Before we wrap up, let’s clarify a couple of misconceptions people often have about the BangNano Prosperity Pyramid:

“It’s Only for Wealthy People”

Not true. The whole point of fractional ownership and collaborative financing is to lower the barriers to entry. Even if you’re starting with very modest savings, you can begin Step 1 (Protect) by converting a small portion of your money into gold or staple goods. Then you can gradually expand.“If I Don’t Live in an Islamic Country, This Won’t Work”

Not necessarily true. While BangNano operates within the framework of Islamic finance of certain countries–such as Indonesia, participation may still be possible depending on your location and circumstances. Many diaspora Muslims worldwide (and even non-Muslims seeking ethical financial alternatives) have already joined BangNano chapters in countries where they are available.- If there is a BangNano chapter in another country, you may be able to join and benefit from it remotely while waiting for expansion into your region.

- As the movement grows, there may be more opportunities for participation in different locations.

However, financial activities are subject to local laws and regulations, which means certain programs or models may not be available everywhere. If you’re unsure, it’s best to seek guidance from existing BangNano chapters and legal experts in your country.

“I Need to Quit My Job Immediately to Start a Business”

There’s no rule that says you must quit your day job to adopt this approach. In fact, many members transition gradually: they keep their job for steady active income, use that income to invest in riba-free programs, and only consider leaving if (and when) their passive income is sufficient.“The Growth Rate Will Be Too Slow”

You might be surprised. While the pyramid encourages cautious investing that steers clear of speculation or extreme risk, the community-based model can generate meaningful results faster than you think. Plus, you avoid the large amounts of debt and exploitative interest payments that often weigh people down in conventional systems.

A Call to Commitment

Adopting the BangNano Prosperity Pyramid is a commitment—to your personal financial future, to your family’s well-being, and to the community’s collective upliftment. It’s not a shortcut or a magic pill; it requires effort, discipline, and a willingness to learn. But the rewards—both in peace of mind and in tangible assets—can be life-changing.

Remember: Real financial independence is about more than money. It’s about your ability to serve Allah, care for your family, and contribute to society without being shackled by endless bills, debts, and interest payments. It’s about regaining control over your time, so you can focus on what truly matters in life: faith, relationships, health, and purposeful work.

Conclusion

This chapter marks the bridge between understanding the problems of the current economic system (Part 1 of this book) and actually doing something about it (Part 2). Here, we’ve introduced the BangNano Prosperity Pyramid—a clear, three-stage process to move from financial vulnerability to genuine independence. With some discipline, community support, and the right mindset, you can break free from the typical traps of riba-based finance and chart a course toward sustainable, faith-aligned prosperity.

Up next, in Chapter 5, we’ll deep-dive into Step 1 – Protecting Your Wealth. You’ll discover concrete tactics—like hedging against inflation, reducing or eliminating riba-based debt, safeguarding your assets through the BangNano public ledger, and planning for emergencies. By the end of it, you’ll be ready to secure your boat so that leaks are minimized and you can confidently set sail toward the next stages of your financial journey.

So, let’s begin: gather your spreadsheets or budgeting tools, talk with your family, and begin the process of clarifying where you stand financially. Once you’ve built that foundation of awareness and discipline, you’ll be perfectly positioned to move forward—one step at a time—up the BangNano Prosperity Pyramid, and ultimately become not just financially secure for yourself, but a force for good in your community and the wider world.

To learn more about Almir Colan’s work on Islamic finance, economy, and management, visit https://www.almircolan.com/blog/IslamicEconomy↩︎