Appendix A — History of the Modern Fiat Currency

The story of modern fiat currency—and how it came to dominate economies worldwide—helps us understand why prices keep rising and why our money seems to buy less over time. By looking at how currencies lost their gold backing and how the US dollar became the global benchmark, we can see how today’s system exposes ordinary people to inflation and hidden risks. Here’s a concise overview.

Gold as the Original Foundation

For centuries, many major currencies were tied directly to gold (or silver). A government would issue paper money, but you could theoretically exchange those notes for a specified amount of gold. This arrangement placed a natural limit on how much money could be printed: if a government tried to create more paper than its gold reserves could support, it would risk a run on the bank or a collapse of trust in its currency.

- Stability: Because gold supply increased only gradually, paper money linked to gold tended to hold its value more steadily.

- Confidence: Citizens trusted the currency, knowing it was redeemable for precious metal if they wanted “hard” value in hand.

The Rise of the US Dollar and the End of the Gold Standard

After World War II, the United States emerged as the world’s economic powerhouse. The Bretton Woods Agreement (1944) established a system where many currencies were fixed to the US dollar, and the dollar itself was pegged to gold at $35 per ounce. This made the dollar extremely attractive globally: if you held dollars, you essentially held a claim to gold at a stable rate.

- The Dollar as the World Reserve Currency

- Nations used US dollars for international trade, especially for essential commodities like oil.

- Other countries’ central banks stored large amounts of dollars in their reserves, making the US currency an anchor for global finance.

- Nations used US dollars for international trade, especially for essential commodities like oil.

- Nixon Ends Gold Convertibility (1971)

- Over time, the US printed more dollars than its gold reserves could realistically support. Faced with rising inflation and foreign governments wanting to swap their dollars for American gold, President Richard Nixon announced in 1971 that the US would no longer exchange dollars for gold.

- This effectively ended the gold standard. The dollar became a fiat currency—backed not by precious metal but by the US government’s declaration and the world’s continued trust.

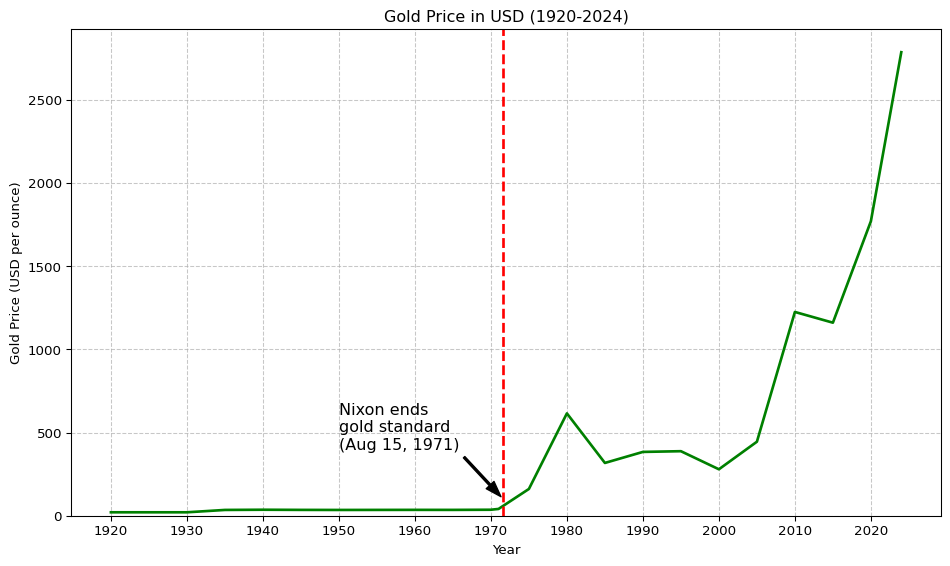

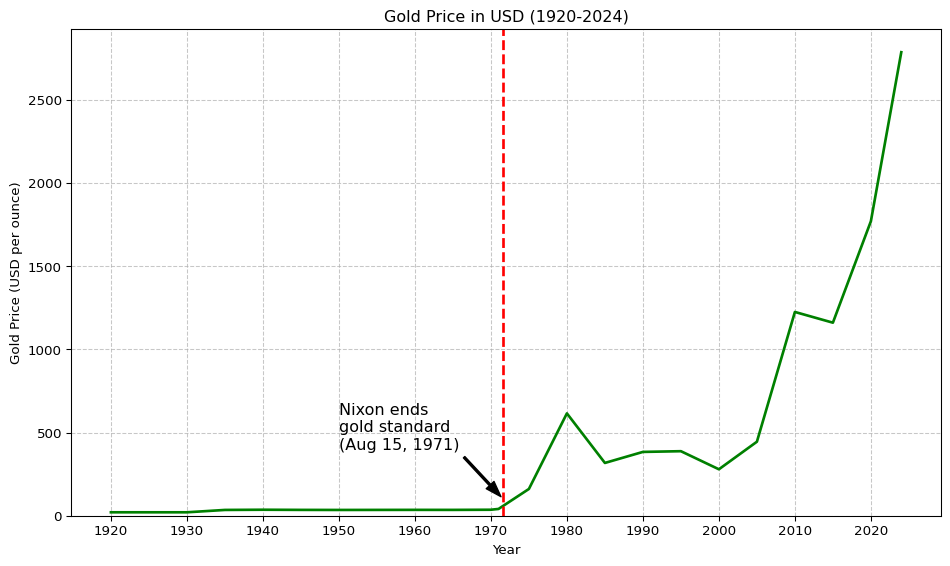

- The effect was a dramatic increase in the price of gold, which rose from $35 per ounce to a peak of $2785 by the end of 2024, an increase of approximately 7857%. (See Figure A.1).

Fiat Currencies Today: USD Dominance and Local Currencies

With the dollar’s key link to gold gone, most countries followed suit and allowed their currencies to “float”—that is, be valued by supply, demand, and economic conditions, rather than a fixed metal rate. Many nations, including Indonesia, kept significant reserves in US dollars, effectively backing their own currency with the greenback rather than gold.

- IDR (Indonesian Rupiah) as an Example

- Like most global currencies, the rupiah is no longer tied to gold. It’s influenced by the Bank Indonesia’s monetary policy and international currency markets. The rupiah’s stability can depend partly on how many dollars the country holds in reserves.

- If the US dollar gains strength or if more rupiah are printed without equivalent economic growth, the IDR weakens, causing local prices to climb.

- Like most global currencies, the rupiah is no longer tied to gold. It’s influenced by the Bank Indonesia’s monetary policy and international currency markets. The rupiah’s stability can depend partly on how many dollars the country holds in reserves.

Everyday Effects of Non-Gold-Backed Money

Since governments and central banks can print money at will (digitally or physically), paper currencies experience inflation—the gradual rise in prices. When more money chases the same goods, each unit of currency loses purchasing power. For everyday people:

- Rising Living Costs: Groceries, housing, education, and healthcare all tend to get more expensive over time.

- Savings Erosion: Money held in a bank account or under a mattress slowly loses value if interest rates don’t keep pace with inflation.

- Dependency on Fiat Stability: In times of crisis (recession, political turmoil), confidence in a fiat currency can drop quickly, eroding wealth almost overnight if inflation or currency devaluation spirals out of control.

Why Tangible Assets Matter

Because governments no longer limit themselves to printing only as many bills as their gold reserves permit, currencies are vulnerable to over-issuance and depreciation. That’s why many financial experts—including those seeking a riba-free approach—caution people to store at least part of their wealth in real, tangible assets. Common examples are:

- Gold and Silver

- Historically used as money for thousands of years, recognized globally as stores of value.

- Tend to hold purchasing power better than paper currencies, especially in times of economic uncertainty or high inflation.

- Historically used as money for thousands of years, recognized globally as stores of value.

- Real Estate

- Land and property often (but not always) appreciate over the long run, as population growth increases demand.

- Physical assets are less prone to sudden devaluation compared to a currency that can be printed out of thin air.

- Land and property often (but not always) appreciate over the long run, as population growth increases demand.

- Staple Goods (e.g., Rice, Cooking Oil)

- In some community-based finance models, storing or investing in basic consumables can be a hedge against rising prices.

- Goods that people always need carry intrinsic demand and can be traded or redeemed without relying on unstable fiat exchanges.

- In some community-based finance models, storing or investing in basic consumables can be a hedge against rising prices.

A Word of Caution and Practical Tips

- Assess Your Mix: While you need some liquidity (cash for daily expenses), holding too much fiat currency can expose you to inflation risk.

- Diversify: Put a portion of your savings into gold, silver, or other tangible assets that historically don’t lose value as quickly when currency weakens.

- Stay Informed: Monitor inflation trends, central bank policies, and global economic events. Knowledge helps you anticipate shifts and protect your wealth.

Conclusion

The shift away from gold-backed money to fiat currency—dominated by the US dollar—fundamentally reshaped the global economy. While it grants governments flexibility, it leaves everyday people vulnerable to inflation and currency devaluation. By understanding how this system evolved and why currencies no longer hinge on precious metal reserves, you can better safeguard yourself.

Consider keeping some of your savings in real, tangible assets like gold or essential commodities to hedge against inflation and monetary uncertainty. This caution is especially relevant in a world where riba (interest) amplifies debt burdens and where central banks can inject more money into circulation at a moment’s notice. Being aware of these mechanics empowers you to make wiser financial decisions and preserves the true value of your hard-earned wealth.